-

We negotiate based on experience and knowledge, without assumptions, guaranteeing results..

- Optimize your investment and avoid unnecessary extra costs.

- We provide you with clear, accurate, and accessible information.

- Close and professional service, the old-fashioned way.

OUR SERVICES:

Mortgage Novation and Subrogation

EPC (Energy Performance Certificate)

Debt refinancing and consolidation

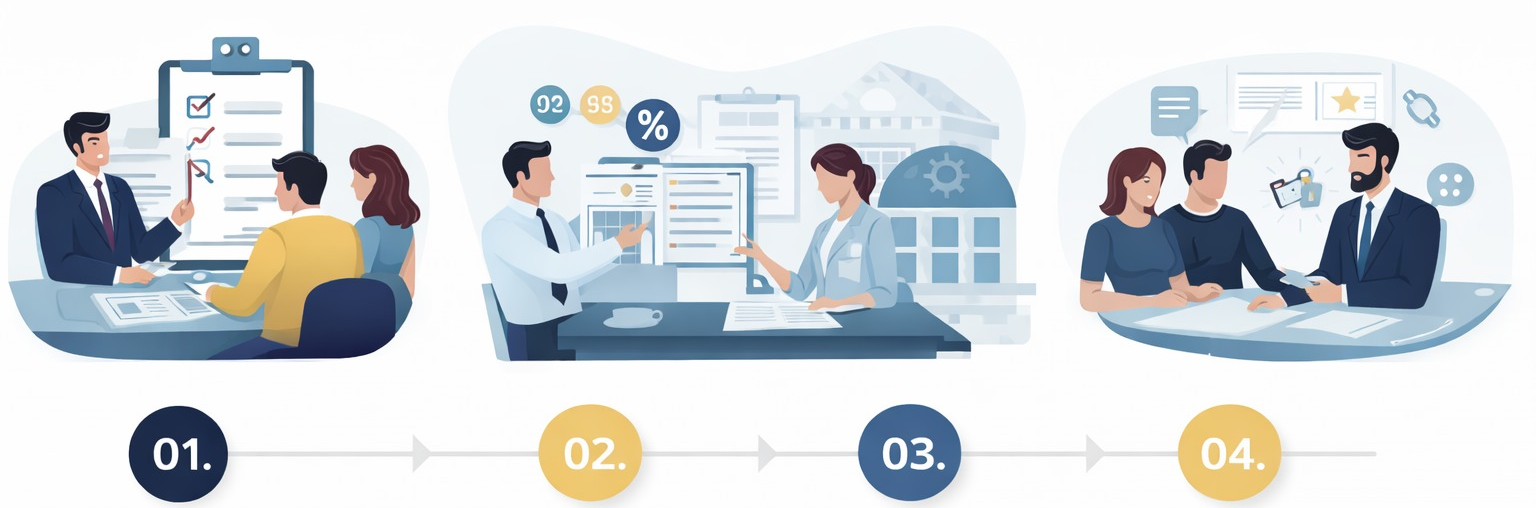

Our procedure consists of four stages:

01. Initial Assessment

We collect and carefully review all the required documentation in order to identify the financial solution that best suits your needs.

02. Presentation of Alternatives

We provide you with different personalized proposals and advise you on each of them, helping you choose the most suitable option.

03. Formalization Management

We coordinate and handle all the necessary steps to formalize the mortgage transaction, including notary, administrative, and related procedures.

04. Final Signing and Support

We take care of all remaining formalities to complete the process. We support and advise you at every stage until the final signing.

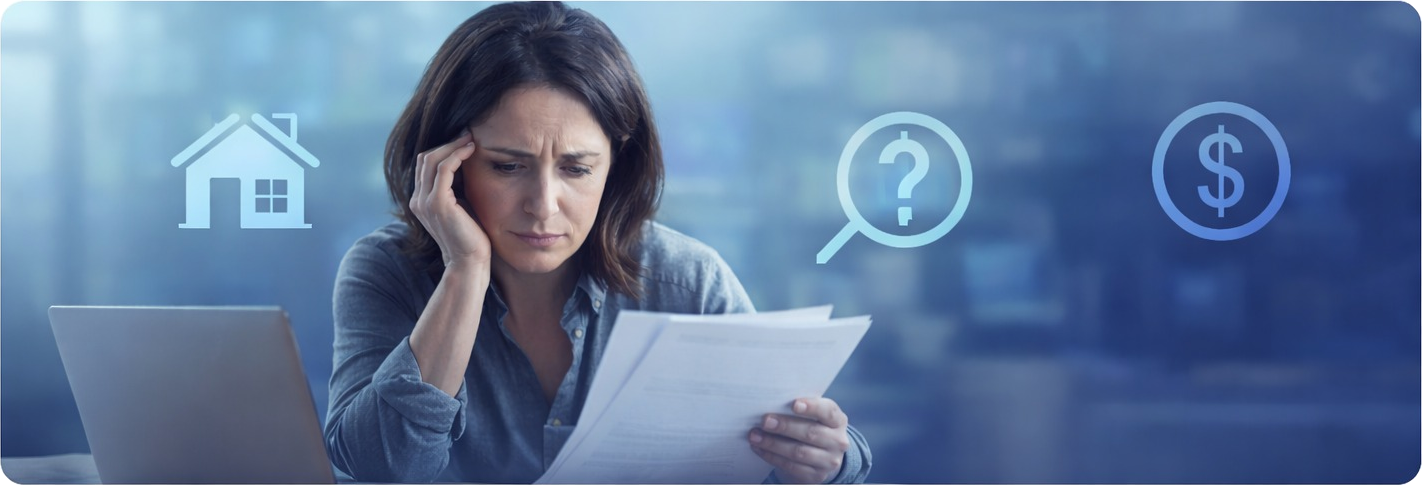

¿Do you identify with any of these situations?:

Have you started learning about mortgages and don’t understand much of what you’re being told?

Concepts like APR, interest rate, linked products, or insurance seem confusing, and you worry about signing something without fully understanding its implications.

Do you feel that banks use language you don’t understand… and that puts you at a disadvantage?

You don’t know whether the offer you’re being given is really good, whether it includes hidden conditions, or if you could get something better.

Are you afraid of making a mistake that could end up costing you thousands of euros?

You don’t want to end up paying more interest, signing abusive conditions, or missing out on a better opportunity due to lack of knowledge or experience.

Would you like to understand every step of the process, but no one explains it clearly?

You spend hours searching for information online, but the more you read, the more confusing everything seems.

Relax, we’re here to help you

Our team will guide you so you understand every step and can make decisions with complete confidence.

checkNo commitment required. checkPersonalized attention. check Confidential.